Research Interests

Financial Reporting

Valuation

Information & Control Systems

Investments

Decision Making

Risk & Uncertainty

Dissertation

Accounting Standards Updates,

Investments in Accounting Information Systems, and

Firms’ Internal Information Environments

Abstract

While the implementation of new accounting standards requires significant firm resources, the literature is largely silent on how firms allocate resources to comply with new accounting standards. I investigate whether firms make information systems (IS) investments to comply because IS are the primary means through which firms’ economic activities are captured, aggregated, and summarized for managerial decision-making. I use a requirement that firms

disclose factors that materially affect their internal controls to identify IS investments. I find that—despite the large direct and indirect costs of IS investments and alternatives to comply with GAAP changes—new accounting standards lead to significant IS investments for the firms most affected

by the GAAP changes. Moreover, the IS investments improve firms’ internal information environments. The results suggest that the IS investments and IIE improvements extend beyond the scope of the GAAP changes.

Committee

Amy Hutton (Chair), Mary Ellen Carter, and Susan Shu

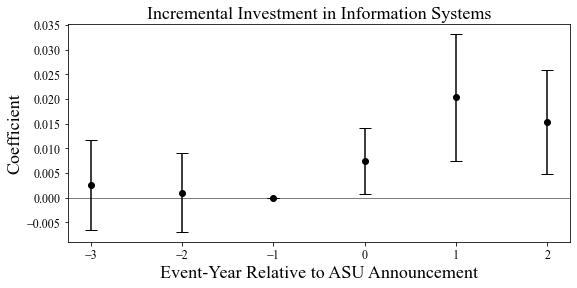

Firms materially affected by GAAP changes invest more in information systems. The points show the incremental investment in information systems for firms significantly affected by GAAP changes in the years surrounding the issuance of the revenue and lease Accounting Standards Updates (ASU). The x-axis is in event-time and centered on the ASU announcement (event-year t=0) and the y-axis represents the incremental investment (i.e., coefficients). The vertical bars report the 90% confidence intervals.

Working Papers

Dissemination of Corporate Disclosures in the Stock Markets and the Cost of Bank Loans

with Carlo Gallimberti and Alvis Lo

We study how regulatory initiatives expanding the dissemination of corporate disclosures in the stock markets might influence the cost of bank loans. The tests exploit the staggered adoption of the EDGAR system required by the SEC in the 1990s, which replaced cumbersome paper filing dissemination with readily-accessible electronic documents. While banks were insensitive to borrowers’ EDGAR adoption, they lowered loan spreads when more of the firms in the borrower’s industry adopted EDGAR, which allowed banks to easily use peer information to help assess borrower creditworthiness. The results are more evident when banks lent to unfamiliar industries and borrowers. Overall, our study highlights that stock market interventions to disseminate disclosures can help address informational frictions even in the private debt sector, suggesting broader economic consequences of regulatory disclosures than previously known. The findings also inform the underexplored interconnections between the public market and banking institutions within the larger U.S. financial system.

Fragility of Financial Misstatements and the Role of Economic Shocks

I examine the role of information processing costs on control systems. Managers use their limited resources and attention to design and execute the internal controls over financial reporting. I find that following large economic shocks, managers reallocate their attention to the control systems and are more likely to uncover preexisting accounting misstatements.